Available Support and SBA Loans for Towing Companies

Due to the Coronavirus outbreak, small businesses around the country are facing financial hardships. However, for those towing companies affected by COVID-19, there are options available that will help you during this challenging time.

On March 27th, the CARES Act was signed into law in order to help business owners across the country. The Small Business Adminstration (SBA) has made loans available through local lenders for towing companies and other small businesses to help pay their employees during this time. According to the Small Business Administration, the CARES Act “contains $376 billion in relief for American workers and small businesses.”

TowingWebsites.com is here to help everyone in the towing community to understand what programs are at your disposal as a result of the passing of the CARES Act.

What Does the CARES Act Include?

The CARES Act establishes SBA funding programs that are normally reserved for economic or natural disasters. Along with this, several new temporary programs have also been created to help with the effects of the COVID-19 outbreak. These programs include:

PPP: Paycheck Protection Program

The employees at your towing company are key in making sure you’re able to serve customers. Due to circumstances brought on by the Coronavirus, many towing companies are looking for ways to keep their drivers, dispatchers, mechanics, and support staff working. Thanks to the CARES Act, the Paycheck Protection Program (PPP) has become available for small businesses, including towing companies, with less than 500 employees. The Paycheck Protection Program is a loan small businesses can acquire to help keep their employees on payroll.

SBA.gov states that the “SBA will forgive loans if all employees are kept on the payroll for eight weeks and the money is used for payroll, rent, mortgage interest, or utilities.” This means you can get a loan from the SBA under the Paycheck Protection Program, and as long as you use the loan funds to pay for eligible expenses a portion of your loan may be forgiven…which means the loan does not need to be repaid. Forgiveness is based on the employer maintaining or quickly rehiring employees and maintaining salary levels. Forgiveness will be reduced if full-time headcount declines, or if salaries and wages decrease.

EIDL: Economic Injury Disaster Loan and the EIDL Emergency Advance

The Small Business Administration’s (SBA) disaster loans are the primary form of Federal assistance for the repair and rebuilding of private sector disaster losses. Typically reserved for natural disasters like hurricanes and tornadoes, disaster loans are now being made available to small businesses affected by the Coronavirus outbreak.

The standard EIDL program has been modified under the CARES Act to provide an Emergency Advance of up to $10,000. The EIDL Emergency Advance “will provide up to $10,000 of economic relief to businesses that are currently experiencing temporary difficulties.” Under the CARES Act, the emergency advance funds were supposed to be direct deposited into an applicants bank account within 3 days of an application, and would be forgiven regardless of whether the full EIDL was approved. This timeline has since been extended, as evidenced by the many businesses who applied and have yet to receive their advance. The SBA stated that advances will start to be distributed the week of April 6th, 2020.

Originally, it was thought that every business who applied would receive a full $10,000 advance, but the SBA has since issued guidance that these advances will be made based on the number of employees you have on payroll. The advance will be calculated at $1000 per employee up to a $10,000 maximum.

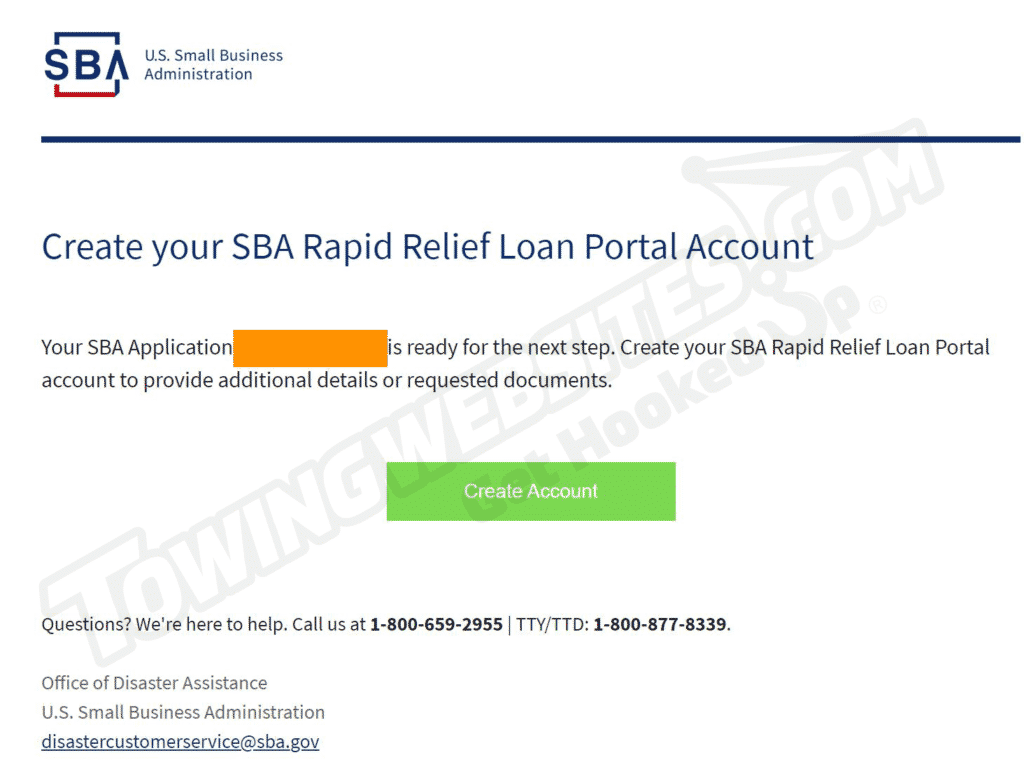

Once your EIDL loan is approved, you’ll receive an email from the SBA with a link to continue to accept your loan. Once you click the link you’ll be prompted to create an account.

EIDL Approval screen on the SBA website.

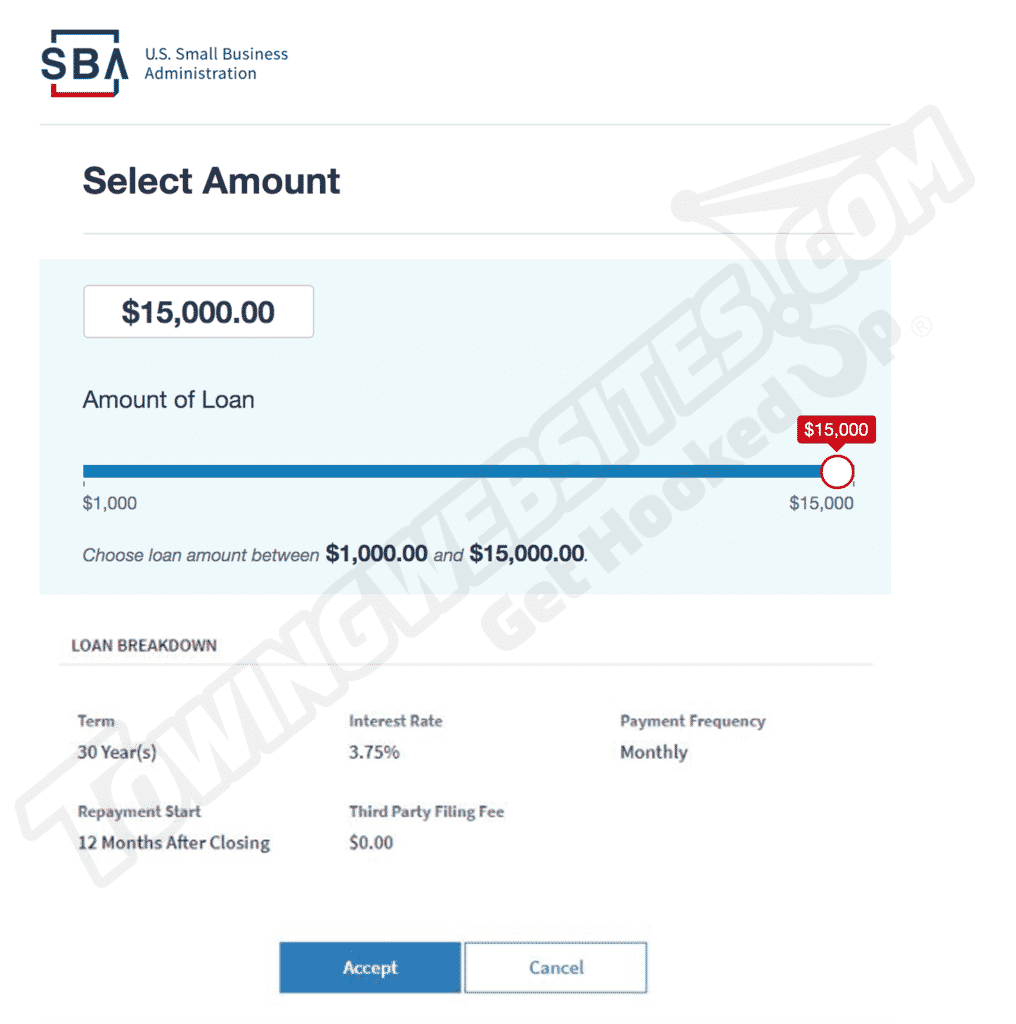

Once you’ve created an account, you’ll be presented with an approval screen showing your approved maximum loan amount. You can select how much you would like to borrow using the slider (up to the approved amount, or $15,000, whichever is higher). The maximum loan amount for this phase of the program is $15,000. You will also be shown the loan term (30 years) and the interest rate (3.75%). At the bottom you can click to accept the loan and loan terms.

Sliding scale for you to select and accept your loan amount.

An SBA District Office released a bulletin on April 6th, with the following information on the EIDL and PPP:

- Borrowers can apply for BOTH an Economic Injury Disaster Loan and the Paycheck Protection Program loan.

- However, the Paycheck Protection Program loan funds and the Economic Injury Disaster Loan funds cannot be used for the same purpose.

- The Paycheck Protection Program loan must be used for payroll (minimum of 75% of the funds received) for it to be eligible for a forgivable loan and the remaining 25% is used for different purposes (mortgage interest, rent, utilities, other services).

- Borrowers who accept both loan funds should document the uses of the funds appropriately.

- If your Economic Injury Disaster Loan was used for payroll costs, your Paycheck Protection Program loan must be used to refinance your Economic Injury Disaster Loan.

- Any advance up to $10,000 on the Economic Injury Disaster Loan will be deducted from the loan forgiveness amount of the Paycheck Protection Program loan.

- For example, a borrower may obtain a loan from the Paycheck Protection Program and use those funds to pay for 8 weeks of payroll or employee retention. They may wish to then dedicate their entire EIDL funds towards working capital, notes payable and accounts payable that do not duplicate the funds provided through the Paycheck Protection Program. If the EIDL loan was used for payroll expenses, the borrower must refinance the EIDL loan with the PPP loan which carries a lower interest rate as well as a shorter maturity period.

- If you are applying for both, you can accept PPP first – then decide whether or not to close on your EIDL approved loan.

- The application period for PPP loans runs through June 30, 2020, but the EIDL application period runs through December 2020.

- EIDL Loan advances will start to be distributed this week. $1000 per employee up to $10,000 max

- EIDL Loans – IF YOU DID NOT APPLY THROUGH THE STREAMLINED PROCESS WHICH STARTED LAST WEEK, SBA request that you visit https://covid19relief.sba.gov/ and reapply with the secure streamlined process. You will not lose your place in queue with your original EIDL loan application.

- EIDL loans will not require a personal guarantee for loans under $200,000.

- EIDL loans will not require real estate collateral for loans under $500,000. SBA will be looking be best available lien priority on all business assets or other business assets.

Other assistance is currently available to small businesses, such as the SBA Express Bridge Loan and SBA Debt Relief programs. You can find out more information on these by clicking directly on the links we included. You can also head over to SBA.gov.

Coronavirus (COVID-19) Relief Through SBA Loans for Towing Companies

Although times are tough, it’s nice to know there’s help out there for all of us in the towing industry. There are even more resources available on the SBA website for those of you looking for additional information. We hope that the SBA does their best to assist the towing community during this uncertain and challenging time. Whether through economic assistance, or advice in general, we can all find ways to keep our businesses strong.

The information provided here was up-to-date as of the publication of this article, but new program guidelines have been handed down by the SBA almost daily since the CARES Act was passed. We encourage you to check with the SBA, your local lender, and your accountant or attorney before making decisions on what is best for your towing company.

Please continue to follow the CDC’s guidelines on how to stay safe and healthy during the COVID-19 outbreak. By doing this, and supporting each other, we can all get through this together.